Most people have heard about ‘stock markets’, but what are they? Here’s a guide to help you understand how stock markets work.

What are financial markets?

Stock markets fall into a wider category known as ‘financial markets.’ What are these, you ask? Well, when it comes to investing, financial markets are where the magic happens. People go there to buy and sell investments – it’s a bit like eBay, but instead of trading bikes or Pokémon cards, people trade different types of investments. Financial markets connect those with money (investors) to those who require money (borrowers, such as governments or companies).

Now, financial markets are quite varied, and they can be divided into subcategories. Typically, each investment type will have its own market– for instance, shares can be found on the stock market, meanwhile you’ll be able to buy or sell bonds on the bond market. And if you’re looking to exchange currency, then the foreign exchange market will be your best option.

How do stock markets work?

Stock markets allow you to buy and sell shares (or stock, they’re essentially the same thing). There are several types of stock markets, including primary and secondary markets.

The primary market is when a company, looking to raise money, sells (commonly known as ‘floats’) its shares for the first time to public investors. In the investment world, we call these initial public offerings, or IPO. The purchase is typically made through an investment bank or broker acting on behalf of the company although both Google and Spotify issued their first public equity offering directly.

The secondary market is where shares of companies are bought and sold by secondary parties, whether they’re investment professionals or rookie investors. Any money changing hands in these sales goes to the investors, and not the company (or investment bank) which initially issued the stock. The price of shares on the secondary market will mainly be determined by the forces of supply and demand. If there are more buyers than sellers, prices will rise. And vice versa, if the number of sellers exceeds the number of buyers, prices will fall.

When you hear people or the media talk about ‘stock markets’, what they’re usually referring to is the secondary market. Now, let’s take this a bit further. Stock markets, or secondary markets, are made up of stock exchanges which are themselves made up of individual stocks. Individual stocks are then combined into indices – this may sound pretty confusing, especially if you’re new to investing, but we’ll use an example to make this a bit clearer.

In the UK for example, you’ve got the London Stock Exchange whose shares feature on a range of indices like the FTSE 100, the FTSE 250, the FTSE 350, and the FTSE All-Share. On each of these stock markets, you’ll find shares of UK companies being traded every single business day.

What are the main stock markets in the world?

There are a huge number of stock markets found all across the globe – here’s an overview of the most famous markets.

The FTSE Indices

As mentioned earlier, the main indices in the UK are referred to as ‘FTSE’ and you’ve got many versions of it. The most known index is probably the FTSE 100 where the 100 largest companies on the London Stock Exchange are listed – we’re talking about companies like HSBC, Tesco, and Sky. The companies on the FTSE 100 make up around 80% of the total value of the London Stock Exchange1. Also, the FTSE 100 is a market-weighted index, meaning companies contribute to the aggregated performance based on their size. So, companies like HSBC, one of the largest members of the index, has a greater impact on the overall performance of the FTSE 100 than other companies.

In addition to the FTSE 100, you’ve got the FTSE 250, which lists the next largest 250 companies on the London Stock Exchange. Now if you combine the FTSE 100 and FTSE 250, you’ll get the FTSE 350. Then, there’s the FTSE Small Cap, which includes over 280 companies that are smaller than those you can find on the FTSE 350. If you put all these indices together, you get the FTSE All-Share. But it doesn’t stop there, because the FTSE All-Share has an ethical cousin, known as the FTSE4Good. On this index, you’ll only find UK companies which are committed to driving positive change in society.

The S&P 500 Index, the Nasdaq, and the Dow Jones

Now let’s go to the US! The main index there is the S&P 500, and it tracks the stocks of 500 large US companies. Amongst these companies, you’ll find tech giants like Microsoft and Apple. Talking about tech companies, there’s an index just for them: the Nasdaq. Part of the New York Stock Exchange, the Nasdaq is the world’s second-largest index based on the market value of the companies it includes.

Another famous index in the US is the Dow Jones Industrial Average (DIJA). Initially, DIJA was an index tracking industrial-sector companies, such as cotton, sugar, and tobacco, but as these firms lost value, DIJA had to update and diversify its listing.

Asian markets

The largest stock exchanges in Asia are located in Japan, China, India, Taiwan, and South Korea. The most famous one is probably the Tokyo Stock Exchange and its performance is measured by the Nikkei 225 Index where companies like Toyota, Nikon, and Sony are listed.

In China, the main stock markets are the Shanghai Stock Exchange, the Hong Kong Stock Exchange, and the Shenzhen Stock Exchange. The total value of every stock traded on China’s markets only represents a third of its economic output2.

Emerging markets

Emerging markets are associated with what we call emerging or developing countries. These nations are often moving away from traditional economies which heavily rely on agriculture and export of raw materials. Some are countries that are rapidly industrialising and adopting a free market, like in the US or Europe. Examples of emerging countries are Vietnam, Brazil, and Egypt.

Since Emerging Markets by definition haven’t reached their full potential, they often offer a greater scope for growth, and if you’re willing to do extensive research and thorough analysis, you, as an investor, could benefit from higher-than-average returns. It’s important to note that as emerging markets are less established than markets in the US, Europe, or Japan, so they typically come with more risk.

Why do stock markets go up and down?

Stock market indices can be like roller coasters, they have ups and downs. Much of the time, markets will move steadily, but sometimes, they’ll swing fast and abruptly. And often, you’ll hear people talk about ‘market volatility’, especially when markets fall. Volatility is simply another word for an acceleration in the magnitude of market movements. When market fluctuations are changeable, moving quickly and very abrupt, we’ll typically talk about it as ‘high volatility.’ And vice versa, if markets are moving slowly and steadily, volatility will be qualified as being low.

So, why do markets go up and down? This may come as a surprise to you, but emotions are often to blame. Investors, even the most experienced ones, are invariably human (or algorithm computers coded by a human), and can be subject to emotions. Being in touch with your emotions can be a good thing, but in the world of investing, emotions can cloud your judgement, pushing you to make rash decisions. As soon as times become uncertain or tough, some investors let panic and fear take control. When economies are slowing down, or political tensions are rising between countries, most people would feel a bit overwhelmed and stressed. Many investors would probably worry about the impact these events could have on their investments. Some may even panic and look for ways to limit potential losses. And driven by the fear of losing money, investors may decide to sell their investments, thinking it’s the most rational thing to do. But is it? If the news is already out there, then the market has probably already reacted. By panic selling, all investors are doing is pushing share prices down, and as prices fall further, more nervous investors will hit the ‘sell’ button, driving markets down and worsening the crisis.

Now let’s imagine you don’t listen to your emotions. Obviously, since you’re human, you can’t always shut down fear or panic, and that’s absolutely fine, it’s healthy to acknowledge your feelings, but you don’t have to give them power, as you could focus on facts instead. So, times are touch, you’re afraid of losing money, and you see investors sell their investments. You can either follow the crowd and listen to your fear, or you can take a step back and try to think rationally about the situation. If you sell your investments, you’ll put a stop to your losses, but you’ll also make them real. Now, if you keep your nerve and stay invested, your losses will remain hypothetical – it’ll only be a scary number on your dashboard, and if markets recover, you could potentially recoup your losses and make a gain over the long-term.

What’s the best way to invest in stock markets?

Active vs passive investing

There’s no right or wrong way to invest. Many investors will pick their own shares and try to outperform the market – this strategy is known as ‘active investing.’ All you need to do is invest in a few companies you think could perform better than the market as a whole. It sounds simple, but it can be very difficult in practice, and many investors, even those with years of investment experience, end up losing the competition. Unless you have some superpowers, it’s almost impossible to beat the market constantly over the long-term. Many have tried, and most of them have failed. The other thing with active investing is that you’ve got to spend a great amount of time researching into companies and analysing market data. But don’t worry, if you don’t have time on your hands, or don’t feel confident enough to pick potential winners on your own, you can opt for actively managed funds. Investment funds are like hampers full of different investments and they’re prepared by investment professionals, known as fund managers. The particularity about active funds is that fund managers will hand-pick investments that are, in their opinion, more likely to outperform the market. If you’re investing ethically, active fund managers will also do the hard work in assessing companies on their ethical standards and picking the ones which can demonstrate a serious commitment in driving positive change in society.

On the other hand, you could try the opposite of active investing and take a different route using passive funds. These investment funds are designed to mirror the collective returns of a stock market rather than outperform it. In other words, passive funds will let you track specific market indices and your returns will depend on the overall performance of markets you’re following. For example, if you buy a fund tracking the FTSE 100, your returns should follow the performance of the UK index. So, if it goes down 10%, your investment will likely fall at the same pace. Alternatively, if the FTSE 100 goes up 10%, your investments should follow and increase 10%.

Long-term investing

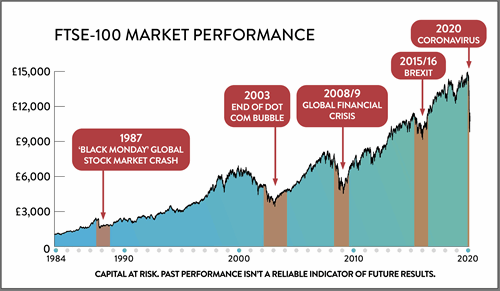

Whatever your investment style, it’s also important to approach investing with a long-term vision. Why, you ask? Well, according to many studies, the longer you stay invested, the greater potential your investments will have and the more likely you’ll be to see positive growth. For instance, people who invested in the FTSE 100 for any 10-year period between 1986 and 2019 have had an 89% chance of making a gain – and this time frame includes major financial crashes, like the Dotcom Bubble in early 2000s and the Global Financial Crisis in 20083.

Diversification

Investing in the stock market involves an element of risk. Remember, markets go up and down unpredictably. So, there’s a chance you could end up with less than you initially invested. However, there are ways to mitigate risk. One way to shelter your investments from bad days is to spread your money across investment types and market indices – this strategy is known as diversification in the investment world and it can help you minimise potential losses. See, investments don’t necessarily move in the same direction, some may be falling, and others may be doing well. So, by having a good mix of shares and other investment types, from different places, you could benefit from these different fluctuations, and poorly performing investments could be balanced out by others doing well. If you want to build a diversified portfolio, funds, active or passive, could help, especially if you don’t have time to pick investments by yourself.

Pound Cost Averaging

Market bumps are more common than you may think. Take the FTSE 100 for example, between 1984 and 2020, the FTSE-100 has seen 5 significant corrections. So as an investor, it’s important to try and learn to live with the bumps. But it’s also a good idea to know how to deal with the drops.

When markets fall, you’ve got several options and here are a few things you could do You could either sell your investments, do nothing and wait for the storm to pass, or continue to invest by drip feeding your investment plan. Also known as Pound Cost Averaging, the last option could help you smooth out market bumps. By drip feeding your plan, or investing little and often, you get to remove emotion from the equation, and you’ll be invested regardless of market movements. This is where it becomes interesting. When markets fall, investments become cheaper to buy and if you’re putting money every month in your plan, you could be in a position where you could grab some bargains and buy at a low price. Now, if markets recover these bargains could potentially see their value increase and you could make a gain in the long run.

How to start investing in the stock market?

Dipping your toe in the investment world can feel intimidating, but it doesn’t have to be! With digital online platforms, like Wealthify, becoming an investor has never been easier! Simply choose how much you’d like to invest and your risk level. We’ll do the rest, from building you a portfolio with the right mix of investments to managing your Plan on an ongoing basis.

References:

1: https://www.thebalance.com/china-stock-market-shanghai-shenzhen-hong-kong-3305480

2: Data from Bloomberg

The tax treatment depends on your individual circumstances and may be subject to change in the future.

Past performance is not a reliable indicator of future results.

Please remember the value of your investments can go down as well as up, and you could get back less than invested.