Flexible Stocks and Shares ISA

✓ Our Flexible Investment ISA lets you withdraw money and put it back in the same tax year — without using up your annual ISA allowance.

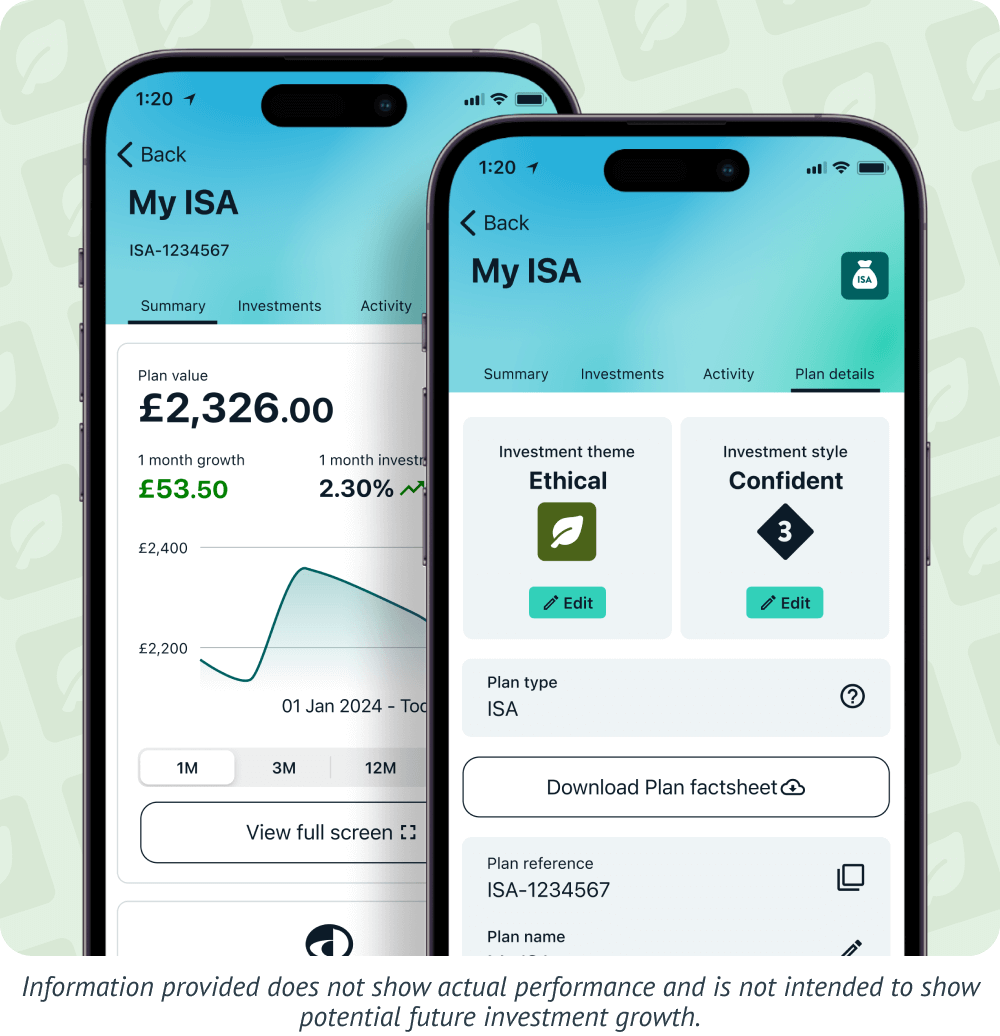

✓ Pick your investment style and change it anytime — while our experts manage your portfolio for you.

✓ Fees are low and transparent, so you keep more of what you invest.

Get started with a minimum £1,000 initial deposit, then make further adhoc or monthly deposits big or small, to suit you.

With investing, your capital is at risk. Tax on investments depends on your individual circumstances and can change. ISA rules apply.

How to open a Stocks and Shares ISA

As with everything we do at Wealthify, we’ve made the process of opening a Stocks and Shares ISA as simple as possible.

You choose

From Cautious to Adventurous, choose your investment style and let us know how much you'd like to get started with.

You answer

Answer a few questions in our suitability quiz, which helps you start an Investment ISA that's right for your circumstances and attitude towards investing.

We build

Our team of investment experts then get to work building your Plan, making sure it’s aligned with your chosen investment style.

We manage

Sit back and let us manage everything for you. Use our online dashboard or app to track your Plan's performance.

Our awards

Is a managed Wealthify Stocks and Shares ISA right for you?

✓ You're happy for our investment experts to pick your stocks for you

✓ You want your portfolio automatically rebalanced for you

✓ You want to invest without the time commitment

✗ You enjoy researching the markets and picking your own stocks

✗ You already have a clear investment strategy in mind

✗ You want to react to market movements and trade on your own terms

Our Plan investment styles

From Cautious to Adventurous, all of our Plans are expertly managed as part of your Wealthify fee

Level 1: Cautious

The focus is on preserving money rather than making large gains.

This Plan aims to have approximately 90% in cash and cash-like assets, with the remainder in low-risk assets such as Corporate Bonds. Small movements up and down in Plan value are to be expected.

Level 2: Tentative

The focus is on limiting losses rather than making high returns.

This Plan aims to have approximately 55% in lower risk assets, with the remainder in higher risk funds made up of global companies. Moderate movements up and down in value are to be expected.

Level 3: Confident

Making gains and controlling potential losses are equally important.

This Plan aims to have approximately 65% invested in higher risk funds made up of global companies, with the remainder in lower risk assets. This Plan sees movements up and down in value, with the aim of getting good returns.

Level 4: Ambitious

Making gains is a priority.

This Plan aims to have approximately 75% invested in higher risk funds made up of global companies, with the remainder in lower risk assets. In order to try and achieve high returns, this Plan could see large movements up and down in value.

Level 5: Adventurous

Maximising gains is a priority.

This Plan aims to have approximately 95% invested in higher risk funds made up of global companies, with the remainder in lower risk assets. In order to try and achieve high returns, this Plan could see substantial movements up and down in value.

See how our Plans have performed

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Original Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% |

| Tentative | 3.88% | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% |

| Confident | 4.87% | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% |

| Ambitious | 5.11% | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% |

| Adventurous | 5.06% | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% |

See how our Plans have performed

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Ethical Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 4.14% | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% |

| Tentative | 6.45% | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% |

| Confident | 9.04% | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% |

| Ambitious | 11.16% | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% |

| Adventurous | 13.43% | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% |

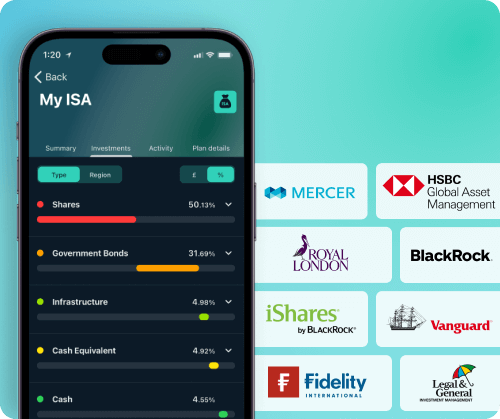

How your money's invested

We invest your money using passive and active investments called mutual funds.

These funds contain a collection of investments – including shares, bonds, and property – and provide the following benefits:

- A convenient, cost-effective way to invest.

- Diversification, meaning your risk is spread.

- Your money tracks entire markets, like the FTSE 100.

Even though the mix of funds will change over time, our team of experts optimise your Plan regularly, keeping it in line with your chosen investment style.

Transferring an ISA?

- You can transfer any Cash ISAs or Stocks and Shares ISAs (Investment ISAs) you have with other providers in to a Wealthify Investment ISA.

- When you transfer an ISA to Wealthify, you should always use the official ISA transfer form to retain the ISA tax benefits.

- Transferring ISAs from previous tax years doesn’t impact your current ISA allowance, so you can still put up to £20,000 into an ISA this tax year.

Our Ethical Stocks & Shares ISA

- Invest in your future and the planet's at the same time

- Five Ethical Plans built in partnership with best-in-class ethical fund providers

- Invest in organisations committed to positive social and environmental impact

- All fund providers are signatories of the Principles for Responsible Investment (PRI) — the world's leading responsible investing framework

- Actively managed funds with rigorous, ongoing screening to ensure ethical standards are maintained

Wealthify Customer Reviews

Looking for support?

Our Customer Care team are always there to help, whether you have a question about your Wealthify Plan, you’re having trouble with the app, or you’re simply unsure of how to get started when it comes to investing with us. Whatever you need, just get in touch.

Telephone

Chat with our friendly team on 0800 802 1800, Monday - Friday, from 8.00am - 5.30pm.

Live Chat

Chat to one of our team online.

Stocks and Shares ISA blogs

Investment ISA FAQs

A flexible Stocks and Shares ISA allows you to withdraw money and replace it within the same tax year without affecting your annual £20,000 ISA allowance. Unlike standard Investment ISAs, where withdrawals reduce your limit for the year, flexible ISAs ensure you do not lose your tax-free allowance.

You can open an ISA with Wealthify if you:

Are over 18

Are UK tax resident

When you’re building your Personal Investment Plan, the first question you will be asked is whether you would like to open an ISA or a General Investment Account. Select ‘ISA’ to create an Investment ISA Plan. Under the current rules, you can have as many ISAs of each type you want (excluding Lifetime ISAs and Junior ISAs), and you can split your annual ISA allowance between them however you like.

If you’re likely to exceed your ISA allowance, you can simply set up a General Investment Plan to invest additional funds. There’s no extra cost for having two or more Plans.

The following initial minimum deposits apply to each of our investment products.

Junior ISA: £500

Stocks and Shares ISA: £1,000

Personal Pension: £1,000

General Investment Account: £1,000

After opening your account, you can top-up (via one-off or regular monthly payments) a Junior ISA, Stocks and Shares ISA, and General Investment Account with £1 or more; Personal Pension payments need to be at least £50.

The ISA limit and maximum you can save each year is £20,000. The tax year runs from the 6th of April to 5th of April the following year. Under the current rules, you can have as many ISAs of each type you want (excluding Lifetime ISAs and Junior ISAs), and you can split your annual ISA allowance between them however you like.

Nothing at all. A Stocks and Shares ISA and an Investment ISA are just different names for tax-free investments.

Yes, you can withdraw funds from your ISA plan at any time, without penalty. Since both our Stocks and Shares ISA and Cash ISA are flexible, you can also withdraw and replace funds within the same tax year without affecting your annual ISA allowance.

For Stocks & Shares ISA, Junior ISA & General Investment Account

We are authorised by the Financial Services Compensation Scheme (FSCS) and investments in these accounts are held by Wealthify itself. This means that in the unlikely event of Wealthify facing insolvency, up to a maximum of £85,000 of your money may be protected under the FSCS.

For Self-Invested Personal Pension customers

Our trusted custodian for pensions, Embark Investment Services Limited, hold your assets separately from Wealthify. This means Embark may offer you up to £85,000 in FSCS protection in the unlikely event they should become insolvent.

All investment customers

The Financial Services Compensation Scheme (FSCS) covers the first £85,000 of your investments. However, it’s essential to understand that the FSCS doesn’t cover you if your investments don't perform as expected (and you get back less than you originally invested). For more information, visit www.fscs.org.uk/.

Along with the FSCS cover outlined above, the companies we work with (and Wealthify itself) are regulated by the Financial Conduct Authority (FCA). All assets in our Stocks & Shares ISAs, Junior ISAs, General Investment Accounts, and Self-Invested Personal Pensions will be held in accordance with the FCA's Client Asset (CASS) rules. This means all parties hold your cash securely and separately from their own. For more information, please read Wealthify's Investment Terms and Conditions.