General Investment Account (GIA)

Freedom to invest on your terms with a General Investment Account.

- A great option if you've used up your annual ISA allowance

- Access the same investment portfolios as our Stocks and Shares ISA, with the same low fees

- Fully managed for you by our team of investment experts

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future. Minimum initial deposit of £1,000 required.

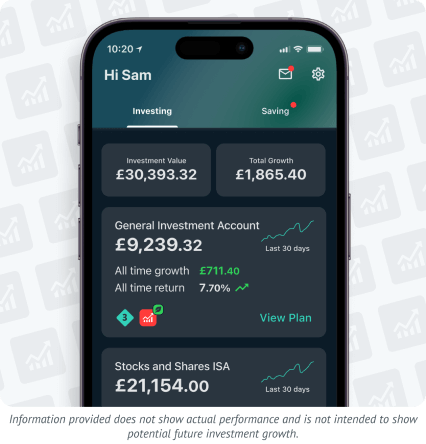

How our General Investment Account works

Setting up a GIA with Wealthify is easy. In fact, all it takes is three simple steps:

You choose

From Cautious to Adventurous, Original or Ethical; start by telling us what type of investor you want to be.

We invest

Once we’ve established your investment style, our experts will build your General Investment Account Plan with just the right mix of investments.

We optimise

You then leave all the heavy lifting to us, as we monitor your Plan on a regular basis, adjusting it to keep everything on track.

General Investment Account benefits

It’s worth noting that if you’re looking to invest and haven't used up your annual ISA allowance, it could be worth checking out our Stocks and Shares ISA, as this offers a tax-efficient way to invest.

If it is a GIA you’re after, here’s why ours might be the one for you:

Flexible: Whether you’re looking to make a one-off deposit or set up regular payments; a Wealthify GIA gives you the flexibility to invest on your terms.

No investment limit: With no limit on how much you can invest, a GIA is a good option if you’ve already used your annual ISA allowance, but still have money you want to invest.

Free deposits and withdrawals: Unlike traditional providers, we won't charge you to deposit or withdraw money, transfer or close your GIA.

Cost-effective: Our experts use a blend of active and passive investment funds, containing types of assets like stocks, bonds, and property to build your Plan, ensuring your money’s invested cost-effectively.

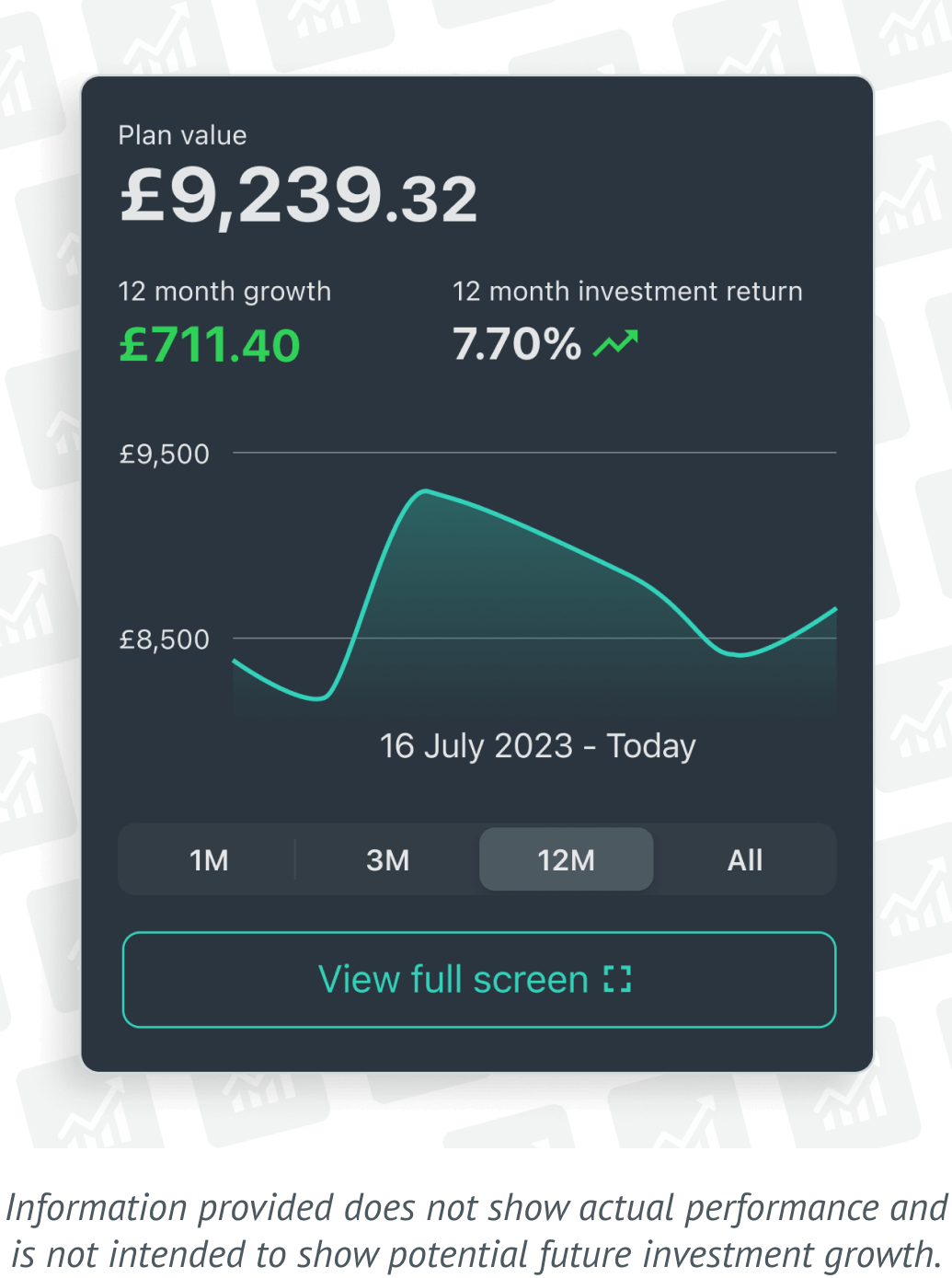

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% |

| Tentative | 3.88% | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% |

| Confident | 4.87% | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% |

| Ambitious | 5.11% | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% |

| Adventurous | 5.06% | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% |

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 4.14% | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% |

| Tentative | 6.45% | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% |

| Confident | 9.04% | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% |

| Ambitious | 11.16% | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% |

| Adventurous | 13.43% | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% |

Awards

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

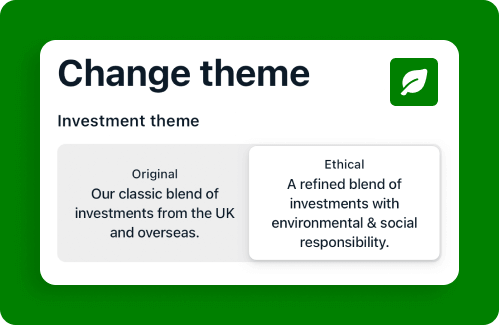

Ethical investing options for your GIA

With a Wealthify GIA, investing for your future also means being able to invest in the planet's future at the same time.

Because, as well as our Original Plans – which use low-cost investment funds to give you the broadest access to the stock market – we've also created five Ethical Plans.

By joining forces with best-in-class ethical fund providers, an Ethical Wealthify GIA lets you invest in organisations committed to having a positive impact on society and the environment. All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world's leading proponent of responsible investing.

With the actively managed ethical funds used in our Plans, fund managers keep a close eye on the organisations they invest in — employing rigorous, ongoing screening to ensure ethical standards are maintained.

General Investment Account fees

Since launching in 2016, lots of things have changed here at Wealthify.

Being completely transparent with our fees, however, isn’t one of them: we charge one annual management fee of 0.6% — and that's it.

This 0.6% management fee is payable monthly based on the value of your investments and covers everything we do, including setting up your account, looking after your money, and optimising your investments.

As with most investments, other costs can apply, but we aim to keep these as low as possible: on average, around 0.15% p.a. for Original Plans and 0.58% p.a. for Ethical Plans.

What is a General Investment Account?

A General Investment Account (also known as a GIA) is a simple, flexible way to grow your money using a wide range of investments, including shares, bonds, and property.

Even though there’s no limit on how much you can invest with a General Investment Account, one of the most important things to understand is that it doesn’t come with any tax benefits (unlike a Stocks and Shares ISA or Self-Invested Personal Pension).

This means you’ll have to pay income tax on any profits you generate from the investments held in your General Investment Account; the amount you have to pay will depend on your individual circumstances and may change in the future.

As is the case with a Stocks and Shares ISA, you should consider keeping your money in a General Investment Account for at least five years, as this gives it enough time to ride out the market's ups and downs.

General Investment Account tax

A GIA doesn’t come with the same tax benefits as a Stocks and Shares ISA or Self-Invested Personal Pension. This means the profits you generate from GIA investments may be subject to Capital Gains Tax. This is how the taxes on investments can differ:

Capital Gains Tax

This is a tax on the profit you make when you sell any investments that have increased in value over time. You'll only have to pay this tax on gains that go above your Capital Gains tax allowance, which is currently £3,000 per year.

Income Tax

Not applicable to your GIA, is income tax. This is for other types of funds and investment accounts that are set to pay out gains on investments as income. The amount depends on individual tax bands and size of those gains.

Keeping your money safe

We know the only thing more important than making your money work harder, is making sure it’s safe — here’s how we take care of yours.

Secure

Your log-in details will be kept secure and never shared with anybody else.

Supported

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

General Investment Account FAQs

Our experts use a range of passive investment funds (like Mutual Funds) to build your Plan. An investment fund is a bundle of lots of individual assets (like stocks, bonds, or property) which you buy all in one go, making funds a cost-effective way to invest.

The mix of funds and investments in your Plan will depend on your attitude to risk. Low-risk Plans will contain a higher percentage of low-risk investments like bonds. Higher-risk Plans will include more shares. Since financial markets are always changing, we’ll make adjustments to the mix of investments in your Plan from time to time.

We’ve created five investment Plans – from Cautious to Adventurous – so you can choose a level of risk that’s right for you. Find out more about what’s in each of these Plans by downloading the Plan Factsheets below.

Original Plan Factsheets

Adventurous Plan [download pdf]

Ethical Plan Factsheets

Cautious Ethical Plan [download pdf]

Tentative Ethical Plan [download pdf]

Confident Ethical Plan [download pdf]

Capital is just another way of saying 'the money you invest'. There’s always a risk with investing that you might not get back everything you put in as markets can go up as well as down depending on a variety of factors.

Why invest in one company, when you can invest in them all? That’s the essence of passive investing. Instead of putting all your eggs in one basket and relying on one particular company to perform well, you spread your money across all of them, so that you benefit from their collective strength. To do this, you need funds like Mutual Funds, which are known as passive investment vehicles. These let your money track an index like the FTSE 100, which is composed of the 100 largest companies listed on the London Stock Exchange.

Passive investing is generally accepted as a more effective long-term strategy than the alternative, active investing, where fund managers try to pick the stocks they think will do best. The Dow S&P Indices show that as few as 14% of active fund managers actually manage to beat the market each year, when looked at over a long time period.

No, that’s what we’re here for. Tell us your investment style, theme and how much you want to invest, and we do everything else. Our Investment Team have pre-selected a range of passive funds, and programmed our automated investment system with algorithms (mathematical formulas) that build your Plan based on what you tell us your goals are.

It is important to remember that with investing, returns are not guaranteed. There is risk associated with investing and you could get back less than you initially invest. To provide you with a sense of what you might expect from Wealthify’s risk-based investment styles, we do provide you with a prediction of performance when creating your Plan. Moody’s Analytics is an independent data provider, who assist in predicting what your Plan values could be in different market conditions over the period of time you plan to invest. It is of course impossible to predict the future, so the projections should only be taken as a guide, not a guarantee. Our investment team have provided factsheets for each investment style which outline their aims for each risk category and will give you an overview of what they are trying to achieve for you in each style. If you have any queries or concerns about the risks involved with investing it is best to seek advice from a financial advisor.

We publish our benchmarks in the valuations we send to all customers, to give you something to compare the performance of your plan against.

We use ARC Private Client Indices as the benchmarks for the majority of our Plans, rather than an index such as the FTSE 100, because we feel it more closely matches the type of diversified investment plans that Wealthify offers. The ARC Private Client Indices are a peer group benchmark which show how other companies’ investment styles have performed. The Indices are based on real performance numbers from hundreds of other Plans. Learn more about ARC Indices.

For our Cautious Plan, we use SONIA (Sterling Overnight Index Average). Rather than investing in stocks, this tracks the average interest rates banks use when lending to each other overnight, providing a lower-risk option for cautious investors.

It’s important to remember that benchmarks and predictions are never perfect and past performance is not an indicator of future growth.

Here are the benchmarks we use for each of our five Investment Styles

| Wealthify Cautious | SONIA (Sterling Overnight Index Average) |

| Wealthify Tentative | ARC Sterling Cautious PCI |

| Wealthify Confident | ARC Balanced Asset PCI |

| Wealthify Ambitious | ARC Sterling Steady Growth PCI |

| Wealthify Adventurous | ARC Sterling Equity Risk PCI |

With investing your capital is at risk and you could get back less than you put in. As an investor, it’s important to understand that stock markets have good periods and bad periods and that you shouldn’t panic at first sight of a bad period. You should think of investing as a long-term prospect, and remember that markets will generally see growth over the long-term.

Yes, we will always let you know if we make a rebalance or substantial changes to your plan, as this can have a significant impact.

We don’t want to bombard you with emails, so it wouldn’t be practical to let you know each time we buy and sell shares in your plan. That said, every transaction appears in your Wealthify dashboard so you can monitor it there if you wish.

There is currently no facility for this, but there may be in future. You can access and withdraw your money 24/7 (Pensions and Junior ISAs can only be accessed upon maturity), although it’s worth remembering that making regular withdrawals will affect how quickly you reach the investment goals you set when you created your Plan.

We typically invest your money within two working days of receiving it. However, it may take a couple of extra days for the investments to show on your dashboard, due to the investing process.

We’ll show your returns for each Plan as a percentage and actual monetary value, so you always know exactly how your investments are performing.

We calculate your returns using the ‘Time-Weighted Rate of Return’ (TWRR) method, which is widely used within the investment management industry. This is the most transparent way to show you your actual return (i.e. how much your money has grown) because it ignores any cash deposits or withdrawals you might have made in the meantime. In other words, it only tells you how much you’ve gained or lost from your investments, not what you’ve put in or taken out yourself.

Your money is looked after by a team of qualified investment managers with experience in established firms all over the world. Our experts have developed an investment system that uses algorithms and industry experience to pick the best funds available to you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

The following initial minimum deposits apply to each of our investment products.

Junior ISA: £500

Stocks and Shares ISA: £1,000

Personal Pension: £1,000

General Investment Account: £1,000

After opening your account, you can top-up (via one-off or regular monthly payments) a Junior ISA, Stocks and Shares ISA, and General Investment Account with £1 or more; Personal Pension payments need to be at least £50.

Yes, all investing carries an element of risk, but Wealthify lets you choose the level of risk you’re comfortable to take. Our five-point scale lets you pick from a 'cautious' (low-risk) approach, to a more 'adventurous' (high-risk) approach. We also build you a diversified Investment Plan, meaning we don’t put all your eggs in one basket. Instead, we spread your investments (eggs) out across a number of different assets and markets (baskets). That way, you’re not relying on one particular ‘basket’ to get a return on your investment. Spreading (or diversifying) your risk is generally accepted as the most sensible way to invest, but it’s still never risk-free.

Please note: customers are all subject to a suitability quiz prior to opening an investment Plan.

From our clear and simple platform to our flexible Investment Plans and excellent customer service; there are hundreds of great reasons why you might want to invest with Wealthify.

We’ve also won a number of awards over the years, including:

- Best Investment Platform for User Experience at the YourMoney.com Investment Awards 2023

- Best Managed Stocks & Shares ISA @ Good Money Guide Awards 2023

- Best Buy ISA, Best Buy JISA, Best for Beginners @ Boring Money Best Buys 2023

- Best Wealth Investment Platform @ Online Money Awards 2023

- Best Pension Platform at the YourMoney.com Investment Awards 2025

Not only that, but our Junior ISA has been named the Best Junior ISA at the Personal Finance Awards six years in a row!