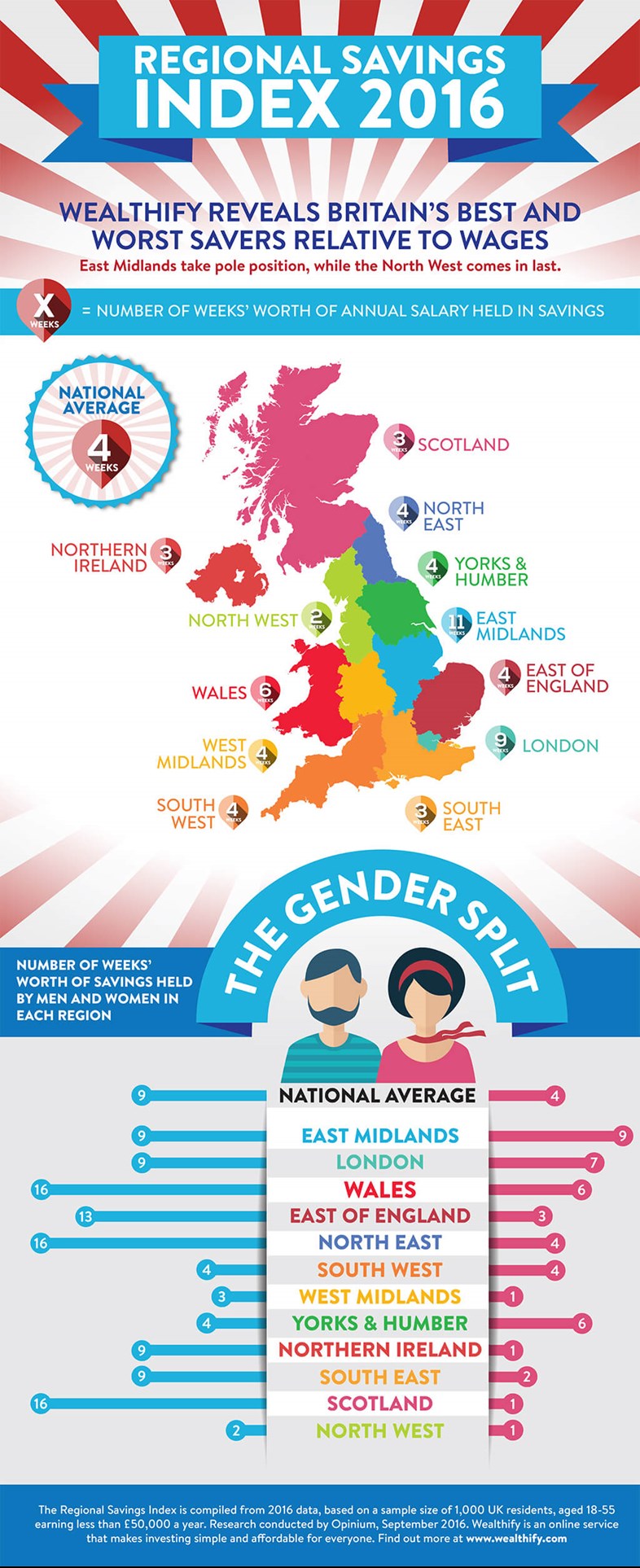

The East Midlands, London and Wales all have something in common. They are the top savers in the UK according to the Regional Savings Index (RSI), a new study by online investment service, Wealthify.

Launched today, the Regional Savings Index analyses the state of Britons’ savings relative to their wages, revealing the average number of weeks’ buffer individuals in each region have saved in relation to their annual salary.

Nationally, Britons have the equivalent of four weeks of their salary in savings, a good deal lower than the three months recommended by most financial planners and experts, to protect yourself against life’s little surprises.

Across the regions, there are big discrepancies in the level of savings held by individuals. East Midlands tops the index with eleven weeks’ salary in savings and London comes in a close second with nine weeks’. At the other end of the scale, the North West and Scotland had just two and three weeks’ worth of savings respectively.

|

|

|

Total savings represented as number of weeks’ worth of annual salary |

|

|

National average |

4 |

|

Regions |

East Midlands |

11 |

|

|

London |

9 |

|

|

Wales |

6 |

|

|

East of England |

4 |

|

|

North East |

4 |

|

|

South West |

4 |

|

|

West Midlands |

4 |

|

|

Yorks and Humber |

4 |

|

|

Northern Ireland |

3 |

|

|

South East |

3 |

|

|

Scotland |

3 |

|

|

North West |

2 |

The Index also looked at the savings habits of men and women in each region, revealing some worrying trends in some areas. Overall the findings show that women are saving less than half that of men and in some cases, men have saved as much as 10 times more than women.

|

|

|

Weeks |

|

|

|

|

Men |

Women |

|

|

National average |

9 |

4 |

|

Regions |

East Midlands |

9 |

4 |

|

|

East of England |

13 |

3 |

|

|

London |

9 |

7 |

|

|

North East |

16 |

4 |

|

|

North West |

2 |

1 |

|

|

Northern Ireland |

9 |

1 |

|

|

Scotland |

16 |

1 |

|

|

South East |

9 |

2 |

|

|

South West |

4 |

4 |

|

|

Wales |

16 |

6 |

|

|

West Midlands |

3 |

1 |

|

|

Yorks and Humber |

4 |

6 |

Richard Theo, CEO and co-founder of Wealthify, says: “The purpose of this index is to highlight how badly people are protecting themselves against financial shock. Hopefully the index will help people recognise the risks they are taking by having inadequate savings. By comparing savings to salary we’re showing the UK’s savings crisis in a new light. Hardly anyone in the country puts away the recommended 3 months’ worth of expenses in an emergency cash fund, let alone has a proper long-term plan. Something has to change. We launched Wealthify to make investing more accessible and to help people grow their savings. We will continue campaigning to highlight the fact that Britons need not only to save more, but take better care of their money too. If they don’t, people’s financial futures could be far from comfortable.”

Please remember that the value of your investments can go down as well as up and you can get back less than invested.

The RSI is compiled from 2016 data, based on a sample size of 1,000 people aged 18-55 earning less than £50,000 a year.