Taking control of your retirement fund can be an empowering thing. We all have aspirations for what our futures will look like, and the lifestyles we want to live in our autumn years.

And as part of that, you probably want to make sure you’re taking advantage of every tax benefit that’s on offer to you in the present — given that pensions come with such an array of helpful advantages.

Opening a personal pot like a Self-Invested Personal Pension (SIPP), for example, comes with more control over how your money is invested, increased flexibility when it comes to withdrawals, and many tax benefits (including a tax relief top-up).

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

- What is pension tax relief and how does it work?

- Pension tax allowance

- Changes to the pension tax relief

- How to claim it

- Other tax advantages to SIPPs

- Summary

What is pension tax relief and how does it work?

When the time comes to withdraw from your pension, you’ll still need to pay income tax on a portion of it. With a personal pension, you’ll get the first 25% of your money tax-free, with the remaining 75% being taxable.

However, as most people paying into a personal pension will have already paid income tax once, a tax relief can be applied (if you’re eligible and opt in).

For each contribution you make to your personal pension, you could receive this tax relief top-up from the government to compensate for the income tax you’ve already paid (not applicable to transfers in).

For the 2025/26 tax year, it’s 20% for basic rate taxpayers. So, if you earn £1,200 as a basic rate UK taxpayer, for example, you’ll typically pay 20% tax, meaning you’ll be left with £1,000. If you pay that £1,000 into a pension, you’ll receive the £250 back as tax relief from the government, working out as a 25% top-up for you.

Why is the top-up 25% and not 20%?

The HMRC tax relief for a standard rate taxpayer is 20%. However, this works out to be the equivalent of a 25% top-up, as it compensates you for the tax you paid ‘at the source’.

Perhaps the easiest way to think of this is:

What if I’m a higher taxpayer?

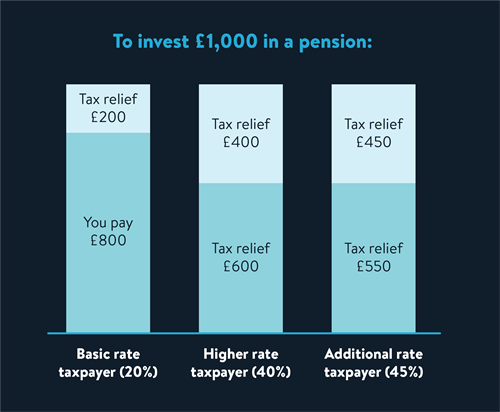

Both higher and additional rate taxpayers are eligible for even more tax relief:

- Higher rate taxpayers = 40% tax relief.

- Additional rate taxpayers = 45% tax relief.

This means higher and additional rate taxpayers need to invest less of their own money compared with a basic rate taxpayer. See this chart to explain the difference:

Note: Different tax brackets apply in Scotland, meaning these amounts will be different for higher and additional rate taxpayers.

Pension tax allowance

Before depositing your hard-earned money into your personal pension, you need to be mindful of your annual pension allowance.

During every tax year, UK adults are entitled to an allowance to save and invest in a pension, ready for their futures.

Your pension allowance is determined either by your annual income, or a fixed amount — whichever is lower. You can choose to pay in more than this allowance, but you’ll face paying much higher tax as a result, which may counteract your intention of using your pension for its tax-efficiency purposes.

The pension annual allowance includes contributions made by you, your employer (if applicable), and the government combined.

During the 2025/26 tax year:

*Learn more about the additional rate tapered allowance in detail here.

Note: If you’ve already started taking an income from your pension or don’t have any UK earnings, you can still pay into a personal pension. However, your annual allowance will be much lower, and you’ll only be able to contribute up to £3,600 (including tax relief).

There’s no limit on the total amount of pension savings you can build up. However, you’ll pay tax if your pension pots are worth more than the lifetime allowance, currently set at £1,073,100 for the 2024/25 tax year.

Pension tax relief changes

In 2024’s Autumn Budget, the government announced that from 6th April 2027, the rules around Inheritance Tax (IHT) will change. This was in an effort to close a loophole, where some people may have been using their pension to avoid paying that tax (rather than what it’s designed for: tax-efficient retirement savings).

Although the details aren’t finalised yet, it suggests that any unused portion of your pension may contribute to your estate (the total amount of your assets that are passed on after you pass away). Pensions you’re already receiving an income from would not be subject to these changes.

There is currently a £324,999.99 threshold in place for the assets you leave behind to your loved ones, so for the average person, these changes won’t affect them. But for higher income earners, anything above the £325,000 threshold would face the 40% Inheritance Tax (36% if you’ve left at least 10% of your estate to charity)[1]. It’s proposed the tax would be taken directly from the pension pot, so that your loved ones aren’t effectively left footing the bill in cash [2].

The government has discussed exploring a ‘single rate’ of tax relief (rather than it falling into income tax bands). While this may be fairer for all taxpayers on one hand, others argue that this single tax relief rate could mean a ‘double tax’ for higher earners. This would mean they pay the difference during their working life, before paying income tax again when they’re withdrawing the money at retirement [3].

We’ll have to keep an eye out on the final outcome for pension tax relief for this over the coming years.

How to claim pension tax relief

The way tax relief is claimed depends on the type of pension you’re paying into. Generally speaking, if you have a personal pension, you’ll typically need to contact HMRC to claim your top-up.

However, with Wealthify’s Self-Invested Personal Pension, there’s no need to fill out forms or wait weeks to get your money. All you need to do is opt in to receive the tax relief as you set up your pension with us, whether that’s starting a new personal pension from scratch, or by initiating a pension transfer (for say, past workplace pensions that you’d rather have in one easier-to-manage pot).

By you holding a Wealhtify SIPP that you also ‘opted in’ to receive this tax relief for, a 25% top-up will be added to your pot every time you contribute to it (up to your annual allowance amount). No paperwork or fuss. You won’t need to do anything; we’ll arrange the payments on your behalf.

Plus, if you have any unused allowance from the past three tax years, you may also be able to contribute more than your annual allowance in the current tax year — and still receive the tax relief. Read about this over on the MoneyHelper’s website.

How to claim higher rate tax relief on pension contributions

As higher and additional rate taxpayers can claim higher larger amounts of tax relief (40% and 45% respectively), this will be a significant boost to their pension pot.

If you’re eligible for this additional amount of tax relief:

- Contact HMRC directly.

- Or send in your information using a Self-Assessment tax return form. Your accountant can help you complete this, if you have one.

Please note: Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.

What other tax advantages do SIPPs provide?

On top of tax relief that’s on offer with a Self-Invested Personal Pension, you’ll also benefit from:

- The efficiency of not paying the standard capital gains tax or income tax when compared to investing in a General Investment Account.

- From 55 (rising to 57 by 2028), you can withdraw up to 25% of your money as tax-free lump sums, regular drawdowns, or purchase an annuity plan.

- At the discretion of the trustee that manages your SIPP — by nominating ‘beneficiaries’ to receive your pension after you pass away, they should have a clear idea of who you’d like your funds to go to. The beneficiaries shouldn’t typically need to pay inheritance tax below the IHT threshold.

There are also benefits relating to combining pension pots to:

- Try to lower your costs of paying multiple provider’s fees.

- Take advantage of the more diverse investment styles a Self-Invested Personal Pension can offer (compared to pension schemes that don’t suit your ethical values or preferred approach to investing).

- Find the management of your pension pot easier with it all in one place.

- Potentially benefit from more compounding interest with your money combined (although better returns are not necessarily guaranteed).

Summary

So, there you have it! With your freshly acquired knowledge of how pension tax relief works, your time spent thinking about building your pension pot no longer needs to be taxing on your mind.

To summarise:

- Your pension pot will be subject to the first 25% tax-free, and the remaining 75% charged at income tax rates.

- You need to ‘opt in’ to receive the pension tax relief top-up to compensate you for the tax you’ve already paid.

- Higher and additional tax rate payers can apply for extra tax relief through a Self-Assessment tax return.

- Unused pension allowances from the past three years can be carried forward.

If you’re still wondering whether transferring your pension to Wealthify is the right choice for you, take a look at our Pension Transfer service. We make it a straightforward process, with ongoing expert management looking to grow your wealth, while maintaining our promise of low and transparent fees. Click the banner below to get started.

The tax treatment depends on your individual circumstances and may be subject to change in the future.

Please remember the value of your investments can go down as well as up, and you could get back less than invested.

Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.

References:

- [1]: https://www.gov.uk/inheritance-tax

- [2]: https://www.gov.uk/government/consultations/inheritance-tax-on-pensions-liability-reporting-and-payment/technical-consultation-inheritance-tax-on-pensions-liability-reporting-and-payment

- [3]: https://commonslibrary.parliament.uk/research-briefings/cbp-7505/

- https://www.moneyhelper.org.uk/en/pensions-and-retirement/tax-and-pensions/tax-relief-and-your-pension

- https://www.moneyhelper.org.uk/en/pensions-and-retirement/tax-and-pensions/tapered-annual-allowance

- https://www.gov.uk/tax-on-your-private-pension/annual-allowance

- https://www.bdo.co.uk/en-gb/insights/tax/private-client/pensions-changes-for-2024-25-onwards-how-they-work