You’ve probably heard ‘inflation’ mentioned quite often – especially in the news – but what exactly is inflation, what does it do, and how does it impact your finances?

Here’s a beginner’s guide to tell you exactly that.

Now, the first (and most obvious) place to start with inflation is with a quick explanation of what it actually is. The dictionary definition is that it’s an economic term referring to a general increase in prices and a fall in the purchasing value of money. And while that’s completely true, it doesn’t quite give you the full picture.

What is inflation?

In the simplest form, it’s exactly as the definition suggests. Inflation is the measure of how much the price of goods (such as bread or mobile phones) and services (such as train tickets or broadband) increase over time. Inflation considers the rise across the entire economy and provides a percentage figure of how much it has risen against what it used to be.

The ‘entire economy’ is key here, as the price of individual items – or even a category of items – can change due to supply and demand. For example, due to the computer chip shortage that was all over the news in 2021, the price for anything requiring a microchip went up as a result.

It’s also worth noting that inflation doesn’t mean that the price of everything goes up at the same rate or that it impacts everyone equally. There are some obvious items and services – like food and drink or electricity – which people pay for regularly.

But again, these goods may not go up at the same rate. As an example, mature cheddar cheese may not have price inflation at the same rate as say, a bottle of soda.

So, inflation impacts your cost of living?

Yes. In a nutshell, inflation’s biggest impact on most people will be a rise in their cost of living. But as inflation is a broad measure, it won’t have exactly the same impact on everyone – and the easiest way to understand this is to consider the things people buy across different age groups.

While they’ll still all require things like food and electricity, the types of purchases made are likely to be different for each group. Just as an example, if you look at how much UK households spent on beef in 2021, you’ll see that people aged 50-64 spent more than any other age bracket.[1]

And this is just beef we’re talking about here. There are millions of variations of this that can make measuring inflation a little bit tricky.

Why should you care about inflation?

Inflation may sound pretty boring, but it will almost certainly touch your life in one way or another. One of the biggest reasons is that, with inflation, money that’s just sat doing nothing could be worth less tomorrow than it is today.

Basically, if your interest rate isn’t higher than the rate of inflation, then your money will have less purchasing power.

Knowing about inflation could change the way that you feel about your money – especially if it’s sat in your savings for the long term. You may want to look at other places to put your money, or even consider investing in the stock market instead. Of course, it’s worth remembering that with investing your money is at risk, which means you could get back less than you invest.

The good news for many people is that wages and salaries often rise with inflation, helping people’s income to stay in line with the prices of the goods and services that they’re using or buying. But inflation can rise faster than the increase in salaries, which can create problems – especially for those whose income doesn’t rise with inflation.

That’s why central banks and the government work together to keep the inflation rate in check – but we’ll talk more about that later!

How is inflation measured?

So, if everything doesn’t go up at the same rate, how is inflation measured? This is done by the Office for National Statistics (or 'ONS'), which put together a basket of common goods and services that the average person might buy.

This basket has over 700 items in it and changes every year to reflect changes in consumer patterns – for example, in 2021, electric and hybrid cars were added to this, as was hand hygiene gel and men’s loungewear bottoms due to the COVID-19 pandemic.[2]

They then monitor how the price changes across these goods and services and regularly update it.

In the UK, we have two main ways that these figures are shown:

- Consumer Prices Index (CPI)

- Retail Prices Index (RPI)

The main difference here is that the RPI includes housing costs by looking at changes in mortgage payments, whereas the CPI doesn’t have this factored in. This does mean that RPI is often, but not always, a higher figure.

Why are there two different inflation measures?

This is a very good question – especially considering that many other countries just use the CPI-type calculation – but there are a few reasons as to why there are two measures.

The first, and most prominent, issue is that RPI includes housing costs.

Why is this an issue? Because of fiscal vs monetary policy. In simple terms, there are a few ways that the economy can be kept in check and one of them is to change interest rates on borrowing.

But many mortgages are tied to interest rates, so that means if interest rates were increased to try and bring inflation down, it would actually end up increasing inflation as monthly mortgage costs would increase - making RPI go up too.

There’s also a difference in how these two inflation measures are worked out. If you want to get really technical about it, the Retail Price Index is calculated mathematically and the Consumer Price Index is done geometrically. What does that even mean?

Basically, by calculating inflation geometrically, it looks at whether people will still continue to use those goods and services as much when prices go up. Typically, this has a minor effect, but it could have a more significant impact – especially on items like clothing and footwear.

Are there problems with measuring inflation?

As you might imagine, there’s a lot of wheels in motion when it comes to measuring inflation, so there are a few issues with measuring it too.

One problem is that the price of food and energy can be volatile, which impacts the overall rate of inflation. To negate this, there’s a second inflation index, referred to as the “Core CPI”, which removes food and energy from their measurements.

Another issue is the quality of goods you receive over time for the same price. Just look at computers, as an example – the difference in power and performance of a £1,000 laptop today would drastically outshine a similarly priced one from a decade ago.

What causes inflation?

So, now that we know how inflation is measured, let’s take a quick look at what causes it. There are two main types of inflation, and these are:

- Demand-pull

- Cost-push

What is demand-pull inflation?

Demand-pull inflation typically happens when a government or central bank stimulates the economy. This could be done by lowering interest rates and lending money to banks so that they increase the amount of credit, or central banks can create money to buy assets like government bonds.

Either way, the general principle is that more money is introduced into the economy, encouraging higher demand and higher prices.

This higher demand means that companies and manufacturers need to increase their output to match demand, which then creates more growth (and also means more jobs). However, to keep up with this increase, companies raise their prices to pay higher wages, and when the economy eventually returns to a stable level of output, it would have higher inflation.

The problems happen if inflation gets out of control – where wages need to increase to keep up with rising prices, which then requires higher prices to pay the higher wages, and a vicious cycle is formed. If this continues, it could lead to hyperinflation, where money becomes worthless, and people switch to bartering or take their money out of savings to buy commodities like gold, silver, or property instead.

What is cost-push inflation?

Cost-push inflation happens when overall prices increase due to the rising cost of wages or raw materials, but without seeing an increased demand for goods or services. As the demand hasn’t changed but the production cost has, the consumers end up having to pay more for these increased prices. This type of inflation is typically bad, as wages don’t increase at the same rate.

Some examples of cost-push inflation would be if a manufacturer uses a rare metal in their product, like gold. If the price of gold goes up, then the manufacturer may choose to pass that cost on to the customer. This could also happen with labour costs – for example, if the minimum wage increases, then a company may increase their prices to pay their workers more money.

Natural disasters may also cause cost-push inflation. For example, if the production facility is damaged and has to shut down, it could result in higher production costs. If this happens, the company might increase prices to help recover some of their losses.

Who keeps the rate of inflation in check?

In most countries, the job of managing inflation will fall on the central bank – often in line with targets set by the Government. For example, in the UK, it’s the Bank of England that keeps the rate of inflation low and stable. In the United States of America, on the other hand, this task falls to the Federal Reserve.

The Government sets the central bank an inflation target (in the UK, the target is 2%), with measures to stop it from becoming too high or too volatile, which helps businesses and manufacturers to plan for the future.

How is inflation controlled?

There are a few ways that governments and central banks can control the rate of inflation, but it largely boils down to fiscal vs monetary policy.

We’ve covered this fully in a separate article, but the take-away points are:

- Central Banks can increase or reduce inflation rate and even control how many government bonds banks need to hold

- Governments can influence taxes and spending, either choosing to increase or decrease either to influence the rate of inflation

What are ‘real’ and ‘nominal’ prices?

You might have seen the terms ‘real’ and ‘nominal’ prices crop up when there’s talk about inflation. Put simply, ‘real’ prices are the ones that are adjusted for inflation — for example, £10 spent in 1980 would have a ‘real’ value of £40.79 as recently as May 2023.[3]

The ‘nominal’ value would just be £10, as it’s doesn’t consider the impact of inflation.

It’s important to know which value you’re talking about, especially as not all figures will be quoted in the same terms. For example, economic growth is typically presented in real terms, while investment terms – especially in the short to medium term – are often given in nominal terms.

This is really important to know when saving because if your interest rate is 0.5% but the annual inflation rate is 2%, then your interest rate is actually — 1.5% and your money is losing value.

However, say you chose to invest that money then you have more potential to beat inflation and give your money a fighting chance. For example, if you’d have invested your money in a Confident Plan with Wealthify in April 2016, and stayed invested until April 2021, you could have seen a 34.27% growth.[4] Although it’s worth noting that you wouldn’t have beaten inflation every year, which is why it’s considered a good idea to stay invested for the long term.

Factoring inflation into your money can make a significant difference to its value in real terms.

Is deflation a thing?

Yes. Just like a balloon, the economy can have inflation and deflation. This could happen across one industry or the entire economy, meaning that consumers can buy more for their money.

When deflation happens, or inflation falls too low, then people may stop buying things as they think that prices could fall further. And although the idea of lower prices sounds great, if this reduced spending continues, then it can reduce economic growth — causing businesses to go under, and in turn, increasing unemployment.

How can I beat inflation?

Investing in the stock market is a great way to try and beat inflation, although it’s not without its risks. With investing, your returns aren’t guaranteed, and you may get back less than what you put in.

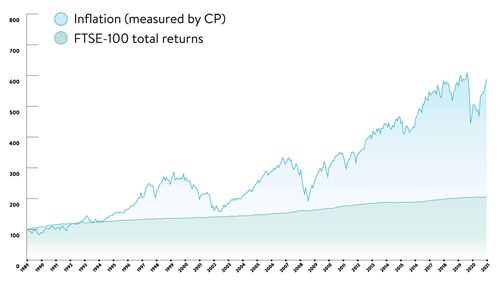

That said, between 1990 and 2021, the FTSE 100 (an index of 100 companies based in the UK that you could invest in) has returned an average of 6.36% each year compared to inflation (measuring as CPI) having an average rise of 2.25% a year for the same period.[5]

As you can see from the chart below, the FTSE 100 returns haven’t been stable – or even consistent – but in the long term it returned 557.54% compared to inflation rising by 99.46%.[5]

But investing all your money into one stock or asset (such as gold) can be very risky. If that company goes bust or the price of that asset drops, then you could end up losing a lot of money.

Luckily, there is something you can do to reduce the likelihood of this happening. And that something is called 'diversification'.

All this means is that instead of picking one thing and putting all your money into it, you invest in lots of different things. These could include shares in various companies (from all types of industries all over the world), government bonds, corporate bonds, and assets like gold, copper, oil, property. It could even include keeping some of your money in cash.

The best bit? This doesn’t have to be complicated. With Wealthify, we’ll build you a fully diversified investment plan then manage it for you, and our lowest risk Plan aims to minimise losses and beating inflation. This could offer you more potential than sticking your money in a bank and is designed to ‘stay the course’ with small movements up and down in the value of your investments to be expected.

If you want to maximise your potential returns, then you’d need to be comfortable accepting more risk – here’s everything you need to know out about our investment risk styles.

Ready to get started? Signing up with Wealthify is simple, and with a Stocks and Shares ISA, you can keep more of your money. Thanks to your ISA allowance (which is £20,000 for the 2025/26 tax year), you can invest up to this much without paying tax on any gains your money makes.

- https://www.statista.com/statistics/285468/beef-weekly-household-expenditure-in-the-united-kingdom-uk-by-age/

- https://www.ons.gov.uk/economy/inflationandpriceindices/articles/ukconsumerpriceinflationbasketofgoodsandservices/2021

- https://www.bankofengland.co.uk/monetary-policy/inflation/inflation-calculator

- https://www.wealthify.com/blog/5-years-of-strong-returns

- Data from Bloomberg

Please remember that past performance is not a reliable indicator of your future results.

With investing, your capital is at risk, so the value of your investments can go down as well as up, which means you could get back less than you initially invested.