Pension Calculator

RELAX INTO YOUR RETIREMENT PLANNING WITH OUR HELPFUL PENSION CALCULATOR.

- Measure the potential of your personal pension pot.

- Define your chosen retirement age and plan ahead for your lifestyle goals.

- See what combining your past pensions could do for you.

- Add lump sum personal contributions or monthly top-ups to change your pot’s projected value.

- Select an investment style that suits you and your values.

With five investment styles available – ranging from Cautious to Adventurous – you can see the potential impact of each, before choosing the one best suited to your individual needs and investment personality.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Why use Wealthify's pension calculator?

Pensions can be a confusing topic for many people. But what it really comes down to for you as an individual is:

- Knowing how to get the most from your money.

- Freeing yourself up to enjoy your well-deserved retirement.

Remove the complexity of your pension pot and help to future-proof your financial planning with the help of our handy pension calculator.

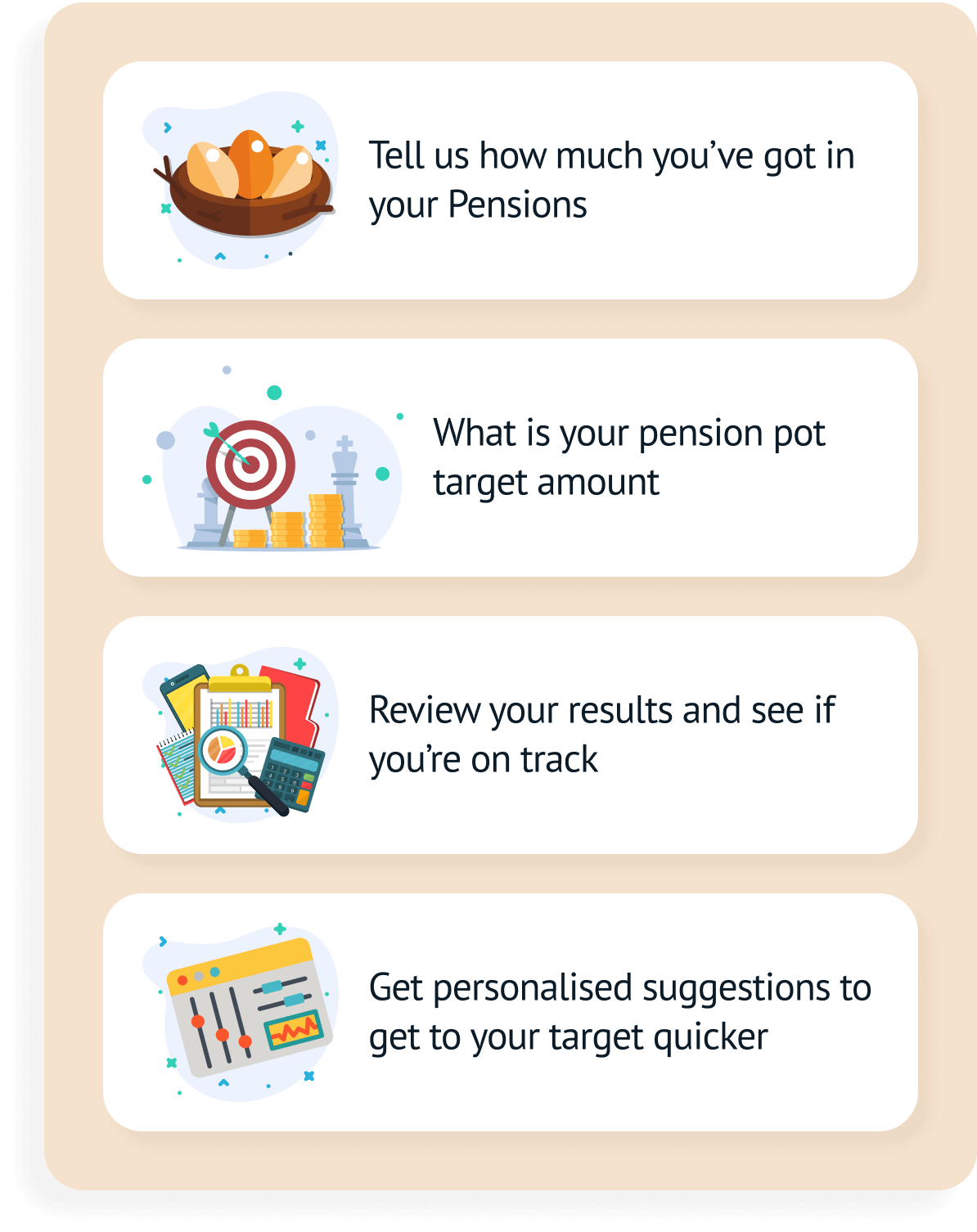

To see what your pension’s projected value could be, simply:

- Enter your details and the target age you hope to retire.

- Tell us about any existing pensions.

- How much you’d like to add in the future.

From there, you can decide whether to retire earlier or later (the minimum retirement age is currently 55 and will increase to 57 in 2028), or make additional contributions to your pension.

Use our calculator to see how making small changes to your retirement age, contributions, or including pension transfers could have an impact on reaching your target goal.

How to calculate my pension

Enter your details

Type in a few basic details and what date you plan to retire.

Your funding

Tell us about any existing pension pots you may be considering transferring and how you would you like to add money to your pot in the future.

See your options

Experiment with our investment styles and themes to find a Plan that suits your needs.

Your retirement target

Set your retirement goal and see what you could do to reach it.

OUR AWARDS CABINET

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

What you’ll find out

Our calculator is designed for you to help with your retirement planning and the results will be unique to you. So, have a play with the options available!

You’ll be able to see your results instantly; and when you’ve decided on a Wealthify Personal Pension Plan that suits your vision for retirement, you can have an email copy sent to yourself and put it into action.

You can start withdrawing from your workplace and personal pension pots when you turn 55 (rising to 57 in 2028), but if your projection is not what you want it to be by that age, you still have a few options to bulk up your pot before retirement begins.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

The benefits of choosing Wealthify for your pension

- Get an instant 25% tax relief top-up from personal contributions.

- SIPP balances up to £100,000 have one annual management fee of 0.6%, and any portion thereafter is charged at a lower 0.3% fee.

- Choose from Ethical or Original Investment Plans.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Secure

Your log-in details will be kept secure and never shared with anybody else.

Supported

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

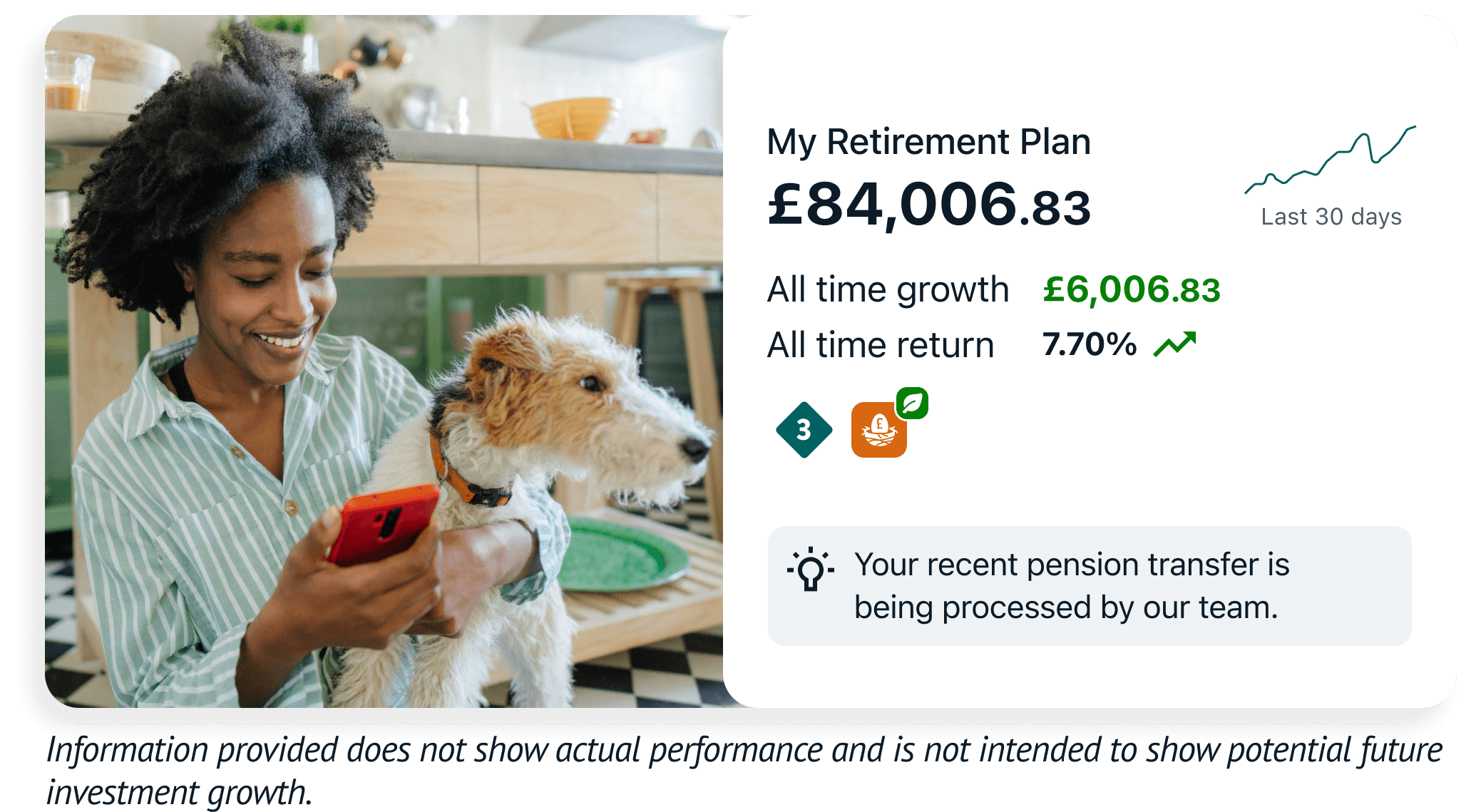

All your pensions in one place

Complete transparency

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a simple annual management fee depending on the value of your investments; 0.6% for pension balances up to £100,000, dropping to just 0.3% for any portion of £100,000 or more.

You’re in control

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Here when you need us

From sign up to draw down, we offer a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Transfer a pension to Wealthify

Consolidating your pensions (transferring your previous pension pots to be all together in one place) could be a good starting point for bulking up your retirement funds.

With Wealthify, you can:

- Manage past pensions all in one place.

- Use our simple transfer process.

- Enjoy straightforward investing (no experience needed, leave it to our team of experts).

Read our pension guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on:

- What a Self-Invested Personal Pension (SIPP) is.

- What the annual pension allowance is.

- How a SIPP differs from a workplace pension.

- Reasons for consolidating pensions.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Our reviews

Pension calculator FAQs

Yes. Inflation is a big factor when looking at your pension, as it’s typically quite a few years away, during which the price of things will continue to go up with inflation.

At Wealthify, we always aim to offer investment returns above what you may expect from a cash savings account in the long term - even with our Cautious Plan. Your Plan continues to work for you throughout retirement, with your remaining funds staying invested after withdrawing a lump sum or taking a regular income.

Our pension calculator works out your retirement income based on the size of your pension and whether you’ll receive the State Pension, and divides this by the number of years you’ll likely be retired for.

For example, if your total pension value is £200,000 and you’ll aim to be retired for 20 years, then your retirement income would be £10,000 a year.

This is entirely up to you and will depend on your personal circumstances.

It may be worth considering when you’ll be able to get your pension; for example, with a personal pension, you can start drawing down from your pension when you’re 55 (57 as of 2028). The State Pension, on the other hand, depends on when you're born, and will be available when you turn 67 or 68.

If you’re not sure when you’ll be able to afford to retire, then it may be worth speaking with a financial advisor.

Understanding how long you’ll live is quite tricky – and more than a little daunting. So that you don’t have to guess, we use the ONS Life Expectancy Calculator, which works out your life expectancy based on your current age and sex.

There are a lot of things that can impact how much money you’ll need for retirement. For example, will you still have a passive income, for example, from renting property? Are you planning on travelling elaborately or just enjoying some peace and quiet?

A general rule of thumb is to aim for a pension that pays out two thirds of their current salary each year. For example, if your salary is £30,000 a year then you may want to aim for a pension pot that pays out £20,000 each year.

It’s believed that your living costs in retirement are lower than they are now. But this assumes that you no longer have a mortgage to pay off and you won’t have commuting and other work-related costs. However, you may have increased medical or mobility costs, so this generalisation may not apply to everyone. If you’re unsure of how retirement will change your living costs, it may be worth talking to a financial advisor.

Currently, there’s no limit on how much you can pay into your pension, however, you won’t receive tax relief on anything over £60,000 or 100% of your salary, whichever is lower. The £60,000 limit includes all payments, including the government top up and employer contributions – so it is actually £48,000 of your contributions, plus £12,000 tax relief.

If you go over this limit you won’t receive tax relief and will have to pay an annual allowance charge which will be added to the rest of your yearly taxable income.

If your income is less than £3,600 a year, you will only be able to contribute up to £2,880 with tax relief. You can make further contributions but will not be not entitled to tax relief on them.

You can access your pension when you turn 55 (rising to 57 in 2028). However, you do not have to withdraw any or all of your pension then. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.

Wealthify automatically adds the 25% top up when you make a personal contribution to your pension and only if you ticked the box to state your eligibility for tax relief when you opened the SIPP. So, if you personally pay in £800, the government adds another £200, making the total £1000. However, if you’re a higher-rate taxpayer, you may be entitled to more, in which case you will need to contact HMRC to be able to access higher-rate tax relief. This will need to be submitted on your annual tax return.

You can transfer most types of pensions to Wealthify, apart from:

- Pensions with a defined benefit (DB), guaranteed annuity rate (GAR), guaranteed minimum pension (GMP), or final salary promise;

- Pensions with protected benefits such as Protected Tax-Free Cash, or Protected Pension Age;

- Pensions you’re already taking an income from;

- Overseas pensions, including Qualifying Recognised Overseas Pension Schemes (QROPS);

- Crystallised plans.

Please note we can only accept defined contribution plans that have no safeguarded benefits or guarantees.