Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

You've been invited to be a contributor!

With Wealthify, it's simple to pay in to a loved ones' Junior ISA. Just follow these three steps and you'll you'll be helping to build a child's future in no time.

How does this work?

What is a contributor?

This is someone specially chosen by the parent or guardian to pay into their child's Junior ISA.

What can they do?

• You can pay into the Junior ISA in a way that works for you

• Any time you contribute, you can attach a special message

• You can easily keep track of how much you've given them

• Making contributions won't affect your tax status or allowances

• Being a contributor is free! You'll only pay what you choose to add

What can't they do?

• You can't access, change, or edit the Junior ISA

• You'll only be able to see your contributions and how much tax allowance is remaining

• All money paid in belongs to the child, so you won't be able to make any withdrawals

who are wealthify?

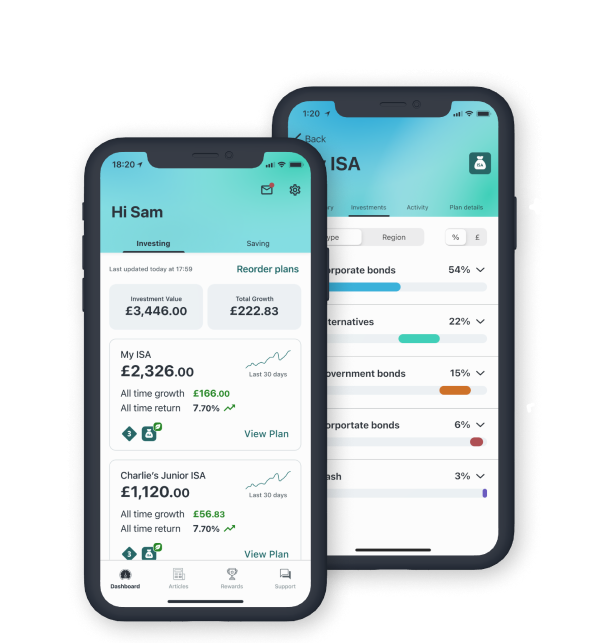

Wealthify is a beautifully simple investment service, backed by Aviva and fully authorised and regulated by the Financial Conduct Authority.

In this case, Wealthify is who uses to provide a multi-award-winning Junior ISA, to give their child's money more potential to grow.

Strength in depth

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.

Wealthify Customer Reviews

Learn more about being a contributor

-

What is a Junior ISA?

-

A Junior ISA is a tax-efficient way to save and invest on behalf of your child.

Payments into a Junior ISA are different from adult ISAs, because the money you put in belongs to your child. Once you put money in, you can’t take it out again, except in exceptional circumstances, and your child can only get access to their money when they turn 18.

There are two types of Junior ISA:

- Junior Cash ISAs: earn interest like a savings account. The interest rate is fixed and typically based on the rate set by the Bank of England.

- Junior Stocks & Shares ISAs: (Also known as Junior Investment ISAs), these invest in financial markets with the aim of earning returns for investors that are greater than those you would get in a Junior Cash ISA. Returns are not guaranteed, and the value of your investments can go down as well as up.

Your child can have one or both types of Junior ISA and you can deposit up to the annual limit of £9,000 into them in any combination you like.

For example, you could pay £3,000 into a Junior Cash ISA and up to £6,000 into a Junior Stocks and Shares ISA, or vice versa. You can split the allowance however you want to between the two accounts.

The benefit of a Junior ISA is that you or your child won’t pay tax on any interest, returns or dividends they receive.

Wealthify only offers a Junior Stocks and Shares ISA. Any money paid into a Junior ISA will belong to the child, but they cannot access it until their 18th birthday.

-

Is my Junior ISA secure with contributors?

-

Yes! By taking the steps for verification and creating separate contributor accounts, we've made sure that your Junior ISA Plans are still safe and secure.

Your contributors will only be able to see how much they’ve added, and the amount left in the Junior ISA's tax allowance for that year. They’ll also be able to see any messages they’ve sent with their contributions.

-

What is a contributor special message?

-

We all like to add a note when you give a gift, so anytime your contributors add to your child’s ISA they’ll have the option of attaching a message for the parent and child to read!

-

Why do they only see their contributions?

-

Money is a pretty sensitive subject, so we don’t want to show them what you or other contributors have added. This way, they’ll easily be able to see how much they’ve added to your child’s future while keeping everyone else’s information private.

For more information read our Privacy policy.