Investments for TSB Customers provided by Wealthify

Wealthify offer an easy and affordable way to invest. Your money is carefully managed by their team of experts and invested in a way that matches your needs. Choose one of the products below to get started.

Choose your Account

What is a General Investment Account?

- A flexible, standard investment account

- No annual limit on contributions - pay in as much as you like

- Returns are subject to tax

- A good option if you've used your annual ISA allowance

- With Wealthify there's a minimum investment of £1,000, and you can withdraw anytime without penalty

What is a Junior ISA?

- A Stocks and Shares Junior ISA that lets you invest for your child's future

- Pay in up to £9,000 every tax year

- Tax free returns

- The money belongs to your child, and can only be accessed by them when they turn 18

- Easily transfer an existing Junior ISA (JISA) or Child Trust Fund (CTF) to Wealthify

What is a personal pension?

- Also known as a Self Invested Personal Pension (SIPP)

- Invest up to £60,000 or 100% of your earnings (whichever is lower) across all your pensions

- We automatically add 25% tax relief

- If you're a higher rate tax payer you can claim additional relief through your tax return

- Minimum initial investment is £1,000 and minimum monthly investment is £50

Why Wealthify?

From rainy days to special days; unexpected bills to poolside chills; your financial piece of the pie to peace of mind: Wealthify is about taking control of your tomorrow — today.

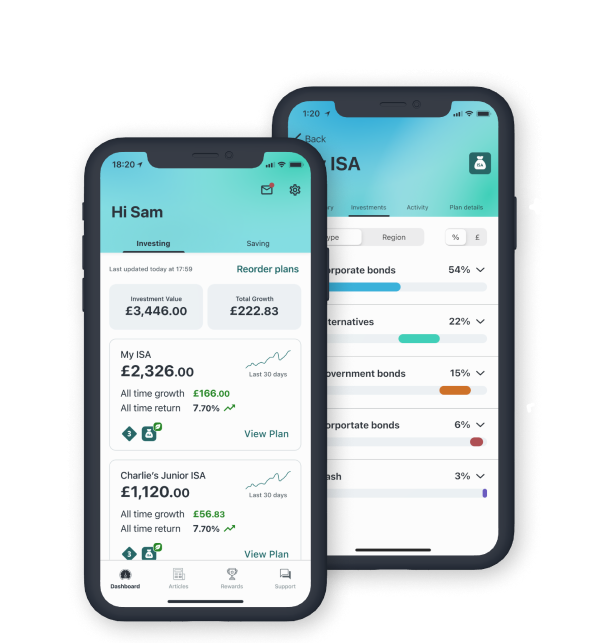

With a range of products, easy-to-use app, and team of experts managing everything for you, it’s about getting more by doing less.

And that's why, if you value your time just as much as your finances, the smart money’s with Wealthify.

Strength In Depth

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.

Wealthify Customer Reviews

Learn more about Wealthify

-

Who is Wealthify backed by?

-

Wealthify is backed by Aviva, the UK’s largest insurance provider and a global financial services company.

Wealthify remains fully authorised and regulated by the Financial Conduct Authority. Our customers’ money will be covered by the Financial Services Compensation Scheme (FSCS).

Aviva and Wealthify are independently covered by the FSCS scheme, so a customer holding funds with both companies will be covered by the FSCS.

-

Is my money safe in my investment Plan?

-

Yes, your money is safe when using Wealthify, as the companies we work with (and Wealthify itself) are regulated by the Financial Conduct Authority (FCA). All assets in our Stocks and Shares ISAs, Junior ISAs (JISAs), General Investment Accounts (GIAs), and Self-Invested Personal Pensions (SIPPs) will be held in accordance with the FCA's Client Asset (CASS) Rules. This means all parties hold your cash securely and separately from their own. For more information, please read Wealthify's Investment Terms and Conditions.

Stocks and Shares ISA, General Investment Account, and Junior ISA

Alongside the protection outlined above, up to the first £85,000 of your money invested with Wealthify may be protected by the Financial Services Compensation Scheme (FSCS), in the unlikely event of Wealthify facing insolvency.

Self-Invested Personal Pension (SIPP)

Our trusted custodian for pensions, Embark Investment Services Limited, may offer you up to £85,000 in FSCS protection in the unlikely event they should become insolvent.

It's important to understand that the FSCS doesn't cover you in the event that your investments do not perform as expected (and you get back less than you originally invested). For more information about FSCS cover for investment products, visit the FSCS website. -

Where is Wealthify based?

-

We’re based in Cardiff, in South Wales. Wealthify is a UK limited company registered in England and Wales (No. 09034828). Our registered office is Tec Marina, Terra Nova Way, Cardiff, CF64 1SA. We are authorised and regulated by the Financial Conduct Authority (No. 662530).

-

Who decides how my money is invested?

-

Your money is looked after by a team of qualified investment managers with experience in established firms all over the world. Our experts have developed an investment system that uses algorithms and industry experience to pick the best funds available to you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

-

Do you provide financial advice?

-

No. We are not regulated to give you advice on whether investing is right for you. If you’re unsure, you should always seek the advice of an Independent Financial Adviser (IFA).

-

Can I pick stocks or choose what I invest in?

-

No, that’s what we’re here for. We build your Investment Plan based on what you tell us about your attitude to risk with money, how much you have to invest, and by when you hope to reach your investment goals. Then we monitor your investments to make sure they’re on track.

-

Is there a minimum amount I need to invest?

-

The following initial minimum deposits apply to each of our investment products.

Junior ISA: £500

Stocks and Shares ISA: £1,000

Personal Pension: £1,000

General Investment Account: £1,000

After opening your account, you can top-up (via one-off or regular monthly payments) a Junior ISA, Stocks and Shares ISA, and General Investment Account with £1 or more; Personal Pension payments need to be at least £50. -

What fees will I pay on my Investment Plan?

-

There are two types of costs and charges to be aware of when investing with Wealthify – a Wealthify management fee and investment costs. Investment costs include fund charges (taken directly by the fund provider) and market spread.

Wealthify Management fee

Wealthify has a simple annual fee of 0.6%, payable monthly based on the value of your investments. This fee covers everything we do, including setting up your account, looking after your money and optimising your investments, which is known as 'rebalancing’. This fee drops to a lower rate of 0.3% on the portion of a Wealthify Personal Pension over £100,000.

Fund charges

We invest your money in carefully selected, low-cost investment funds from providers such as Vanguard and Blackrock. These incur a small annual charge of approximately 0.15% p.a. for Original Plans and 0.58% p.a. for Ethical Plans, which is taken at source by the fund provider.

Market spread

These costs are incurred as a result of the process of buying and selling investments and as such must be considered as part of the overall cost of investing.

To get an idea of what your fee would be, why not check out our Fee Calculator.