Step 1 - Your Details

Enter a few basic details to give us a timeframe to calculate.

Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

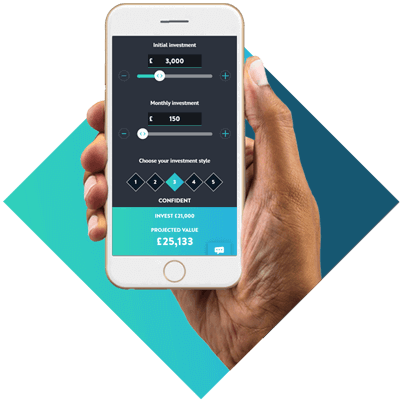

Find out how much your pensions could be worth by using Wealthify's pension calculator to help you with retirement planning. See how combining old pensions - and making contributions through lump sums or regular deposits - could affect your monthly and yearly income in retirement.

With five investment styles available - ranging from Cautious to Adventurous - you can also see the potential impact of each, before choosing the one best suited to your individual needs and investment personality.

Plus, you could earn between £50-£200 cashback by transferring your pensions to Wealthify. You can activate this after you’ve got your pension calculator results.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Enter a few basic details to give us a timeframe to calculate.

Tell us about your pensions and how much you'd like to add in the future.

See how small changes could impact the way your pension grows.

Set your target retirement goal and see what you could to do to reach it.

Our calculator shows what your pension could pay either monthly or yearly, and if you're not sure how much you'll need, our target retirement income will help you figure that out too.

Want to retire earlier or put even more in your pension? Use the calculator to see how making small changes to your retirement age, contributions, or including pension transfers could have an impact on reaching your target goal.

Calculate your pension pot now

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a flat fee to manage your Pension, so you always know where you stand.

About our fees

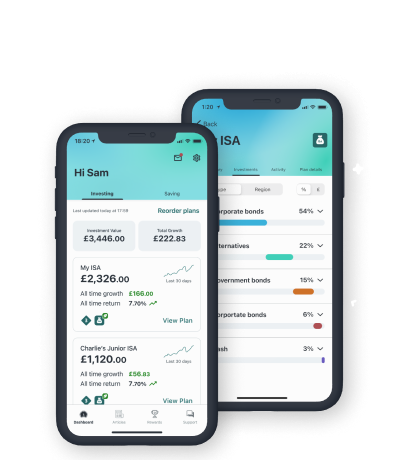

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Get Started

Your login details will be kept secure and never shared with anybody else.

How Wealthify works

From sign up to draw down, we offer no paperwork, no post, just a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Contact usUnderstanding how long you’ll live is quite tricky – and more than a little daunting. So that you don’t have to guess, we use the ONS Life Expectancy Calculator, which works out your life expectancy based on your current age and sex.

Our calculator works out your retirement income based on the size of your pension and whether you’ll receive the State Pension, and divides this by the number of years you’ll likely be retired for.

For example, if your total pension value is £200,000 and you’ll aim to be retired for 20 years, then your retirement income would be £10,000 a year.

There are a lot of things that can impact how much money you’ll need for retirement. For example, will you still have a passive income, for example, from renting property? Are you planning on travelling elaborately or just enjoying some peace and quiet?

A general rule of thumb is to aim for a pension that pays out two thirds of their current salary each year. For example, if your salary is £30,000 a year then you may want to aim for a pension pot that pays out £20,000 each year.

This is entirely up to you and will depend on your personal circumstances.

It may be worth considering when you’ll be able to get your pension; for example, with a personal pension, you can start drawing down from your pension when you’re 55 (57 as of 2028). The State Pension, on the other hand, depends on when you're born, and will be available when you turn 67 or 68.

If you’re not sure when you’ll be able to afford to retire, then it may be worth speaking with a financial advisor.

That depends on your circumstances. In order to get the full basic State Pension, you’ll need a total of 30 qualifying years of national insurance contributions. There are a few ways that you’re able to be eligible:

If you’re still not sure, then you can check with the Pension Service.

The State Pension is a regular payment you should receive from the government when you reach retirement age. And the income you receive depends on you having paid a certain level of national insurance contributions over your working life. To get any state pension, you’ll need at least 10 years’ worth of contributions – if you don’t meet this requirement, you may not receive any money from the government.

For more information on the State Pension, please visit: https://www.gov.uk/state-pension

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.